Banking and Finances

Overview

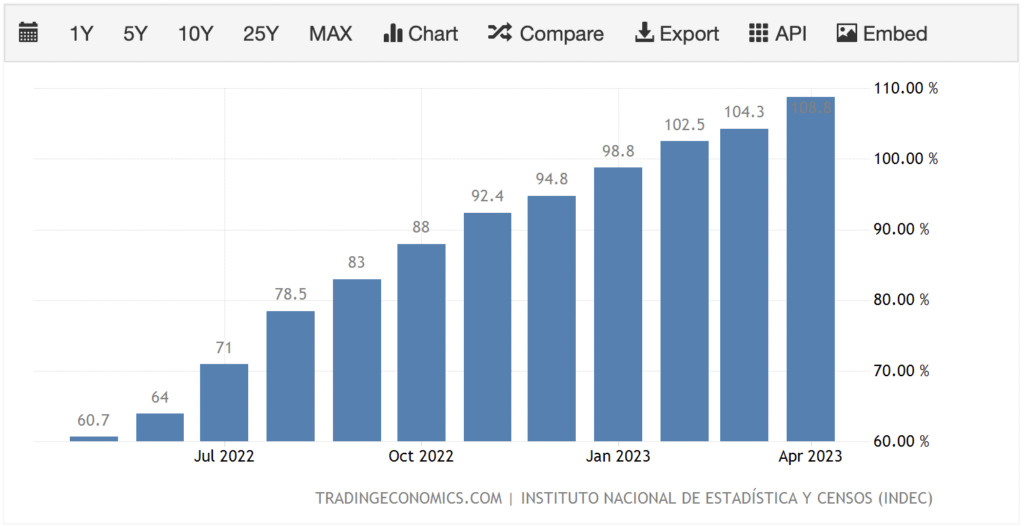

Argentina is plagued by rising inflation, capital flight and heavy-handed government interference in the economy. Current annual inflation rate is 110% and rising. The table below paints a dire picture.

Inflation and economic instability are not unfamiliar to most Russians. However, this situation and the governmental controls on the banking sector which it has spawned have significant repercussions for anyone wishing to spend any time in the country.

Money Exchange and the Dólar Blue

In attempt to curb inflation, the government instituted controls on the banking sector that limit how much money can be withdrawn from banking accounts. You cannot withdraw in US$, only in Argentine pesos.

Dólar Blue is not a typical “black market” currency running a shadow economy controlled by criminal elements. Rather it is a broadly accepted – even if not officially endorsed – as a legitimate form of currency exchange. The Dólar Blue rate is available in any registered currency exchange shop and even for money sent through the Western Union and Moneygram.

The official exchange is used mainly for international trade settlements and for any financial transactions conducted directly through the banking system such as credit card payments.

Because of the large discrepancy between the official and the Dólar Blue rates, banking restrictions and general mistrust of the banks fostered by past incidents when the government syphoned off Argentines’ savings held in bank accounts, Argentina is basically a cash economy. Argentines avoid banks, credit cards and the official exchange rate at all costs, and so should you.

"Foreign Tourist" Exchange Rate

On December 15, 2022, the government launched the “MEP” (“Electronic Payment Market”) dollar exchange rate, otherwise knows as the “Foreign Tourist Rate”, enabling holders of Visa and MasterCard credit cards, issued by foreign banks, to be charged a more favorable exchange rate, which approximates the Dólar Blue rate. The “MEP” rate is approximately 4-10% lower than the Dólar Blue rate, however the convenience of using credit is worth it for many.

As of May, 2023, those foreigners who use digital wallets to pay with US dollars in Argentina on platforms such as PayPal, Amazon Pay, Google Pay will also be charged the “MEP” rate.

Operating in a Cash Economy

Argentina is not just a “cash preferring” country but a “cash demanding” country, where many business ONLY accept cash, (in Spanish to term for cash is “effectivo”). Therefore, even though you may prefer to pay with credit card, it is still imperative to always have some cash in your wallet.

In an economy with a 110% inflation rate, keeping large amounts of Pesos on-hand is not a good idea. Hence, effectively managing cashflow has become a national preoccupation. Here are some tips to consider:

- Avoid ATM and Bank withdrawals. ATM withdrawals are limited to only an equivalent of US$200 in Pesos per day. You cannot get US$ from ATMS and high transaction fees apply, usually between US$8 – US$11 of fees per each withdrawal. Transaction fees may be lower if you withdraw directly from a Bank, but you will still be charged the official exchange rate.

- Exchange money only at money exchanges offering Dólar Blue rates. These exchange places or “Casa de Cambio” are located throughout Buenos Aires. For better rates best avoid the most touristy areas.

- Visit Calle Florida for best rates. .